metatrader 4 (MT4) stands as a cornerstone in the realm of forex trading platforms, renowned for its user-friendly interface, comprehensive charting tools, and extensive range of analytical capabilities. While many traders may be familiar with the basics of MT4, delving into advanced strategies and tactics can elevate one’s trading prowess to new heights.

One of the key features that make MT4 a preferred choice among traders is its flexibility. With flexible leverage options, traders can tailor their positions according to their risk tolerance and trading style. This allows for greater control over capital allocation and risk management, essential elements for success in the dynamic forex market.

One advanced strategy that traders can employ on MT4 is algorithmic trading. Utilizing Expert Advisors (EAs), traders can automate their trading processes, executing trades based on pre-defined criteria and strategies. This not only saves time but also removes the emotional element from trading, leading to more disciplined and consistent results.

Another tactic to master on MT4 is the use of custom indicators and scripts. While the platform offers a wide range of built-in indicators, custom indicators can provide unique insights and signals tailored to individual trading strategies. Additionally, scripts can automate repetitive tasks, streamlining the trading workflow and increasing efficiency.

Risk management is paramount in forex trading, and MT4 offers several advanced tools to aid in this aspect. Traders can utilize stop-loss and take-profit orders to define their risk-reward ratios and protect their capital from adverse market movements. Moreover, the platform’s margin call and margin stop-out levels help prevent excessive losses and ensure responsible trading practices.

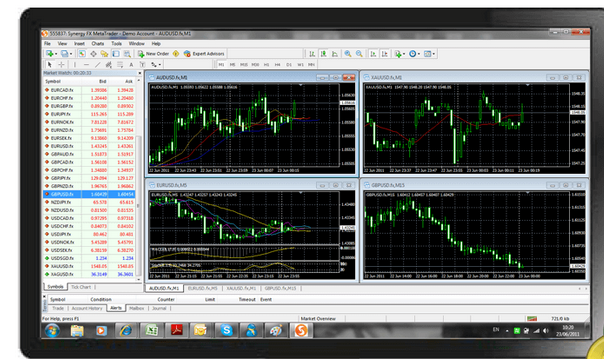

Advanced charting techniques can also be leveraged on MT4 to identify high-probability trading opportunities. From Fibonacci retracements to Elliott Wave analysis, traders can utilize various technical analysis methods to gain insights into market trends and price movements. Additionally, the platform’s extensive range of timeframes allows for detailed analysis across different trading horizons.

Furthermore, MT4’s robust backtesting capabilities enable traders to evaluate the performance of their strategies over historical data. By conducting thorough backtests, traders can refine their strategies, identify potential weaknesses, and optimize their trading approach for better results in live markets.

In conclusion, mastering MetaTrader 4 involves going beyond the basics and exploring advanced strategies and tactics that can enhance one’s trading performance. With flexible leverage options, algorithmic trading capabilities, custom indicators, and advanced risk management tools, MT4 empowers traders to navigate the forex market with confidence and precision. By harnessing the full potential of MT4, traders can unlock new opportunities and achieve their financial goals in the dynamic world of forex trading.